If you are looking for TradingView alternatives, it usually means charting alone is no longer solving your problems.

Some traders want faster scans, others want deeper execution insight, and many want platforms that work alongside their brokers rather than trying to do everything in one place.

TradingView is flexible, but flexibility can also mean compromises.

This guide looks at platforms traders move to when they need sharper focus, stronger data, or workflows built around how they actually trade, not just how charts look on the screen.

Top TradingView Alternatives

If TradingView feels too broad or too chart-centric, these platforms offer tighter workflows built around how traders actually operate.

Each one replaces general charting with a more specialized way to find trades, understand behavior, or improve execution.

1. Trade Ideas

Trade Ideas removes the need to manually search charts by scanning the entire U.S. stock market in real time for specific conditions like relative volume spikes, volatility expansion, and momentum shifts.

Traders build rule-based alerts and let the software surface opportunities as they appear, which changes the workflow from analysis-first to reaction-first.

Best for:

- Momentum and breakout traders

- Prop firm traders needing constant opportunity flow

- Traders who prefer alerts over chart hunting

Because of this structure, many traders use the built-in simulator to train execution and discipline directly from alerts.

Instead of refining chart layouts, they focus on speed, selectivity, and consistency under live market conditions.

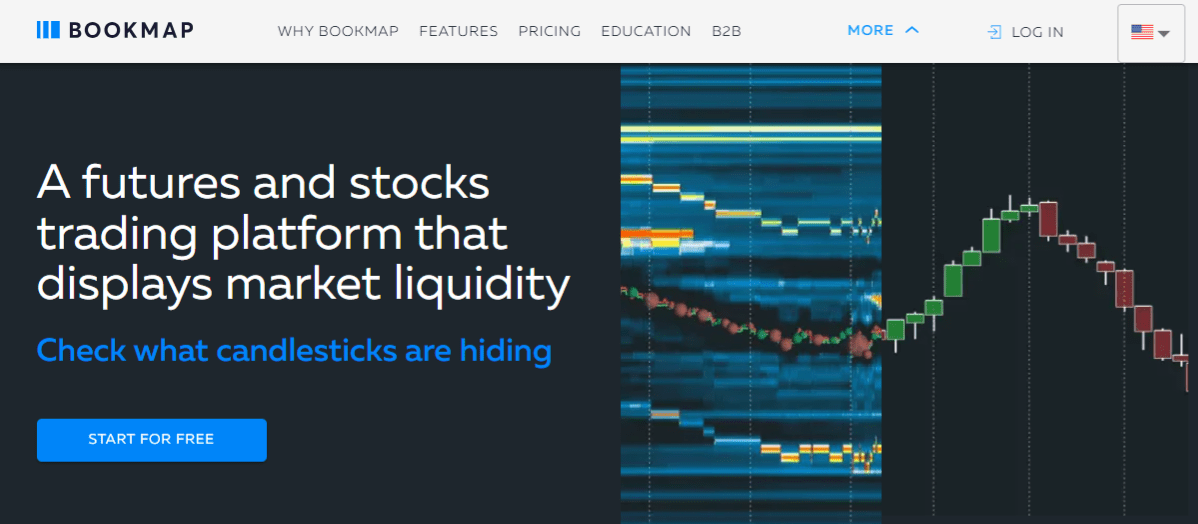

2. Bookmap

Bookmap replaces traditional charts with a liquidity-driven view of the market.

Traders see resting limit orders, executed volume, and aggressive buying or selling plotted directly on price, which reveals behavior hidden from candles.

This shifts analysis away from indicators and toward market participation.

Best for:

- Futures and index traders

- Scalpers focused on execution timing

- Traders who rely on order flow

Most users pair Bookmap with a simple charting platform and only open it when execution matters.

It is not designed for scanning or planning, but for understanding why price reacts at specific levels in real time.

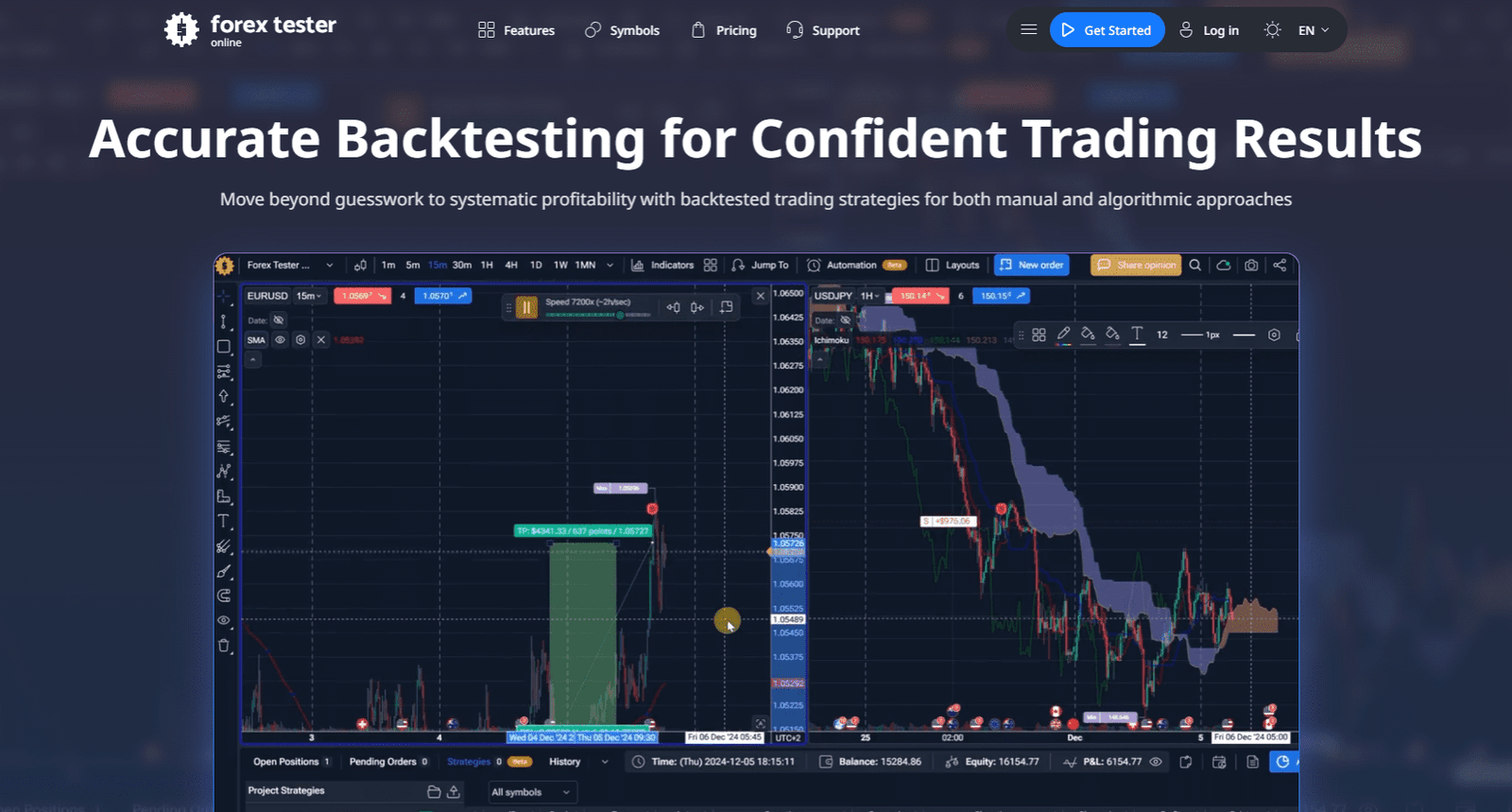

3. Forex Tester Online

Forex Tester Online removes live charts entirely and replaces them with structured historical practice.

Traders replay markets candle by candle, place trades manually, and review detailed metrics like drawdown, expectancy, and risk exposure.

This makes testing repeatable and controlled rather than visual and subjective.

Best for:

- Traders refining rules before going live

- Strategy developers focused on statistics

- Traders who learn through repetition

Instead of reacting to live movement, users focus on improving trade management, position sizing, and consistency.

Many traders use it to eliminate weak ideas before risking capital.

4. TrendSpider

TrendSpider automates much of the technical work traders normally do by hand.

Trendlines, support and resistance, and higher-timeframe structure are detected automatically, reducing bias and inconsistency. This shifts the workflow from drawing and adjusting to validating ideas.

Best for:

- Rule-based and systematic traders

- Traders who plan trades in advance

- Those who dislike manual chart work

The platform is less about reacting in the moment and more about preparation. Traders use it to confirm whether setups have statistical backing before execution ever becomes a factor.

5. GoCharting

GoCharting offers deeper execution insight than standard charts through footprint charts, volume profiles, VWAP bands, and delta tools.

This helps traders understand how price interacts with participation instead of relying on indicators alone.

Best for:

- Futures and crypto traders

- Execution-focused discretionary traders

- Traders wanting depth without clutter

It stays lightweight and browser-based, which makes it practical during live sessions.

Many traders use it specifically to refine entries around high-volume areas rather than for broad market analysis.

Frequently Asked Questions

Is Switching Away From a Charting Platform a Sign That My Strategy Is Failing?

Not necessarily. Many traders change tools because their decision process has matured. What worked during learning phases may feel limiting later. Switching platforms often reflects a shift in focus, such as prioritizing execution, preparation, or discipline rather than raw chart analysis.

Can I Use More Than One Platform Without Hurting Consistency?

Yes, if each tool has a clear role. Problems arise when platforms overlap and create conflicting signals. Many traders use one tool for discovery, another for execution, and a third for review. Clear separation usually improves clarity, not confusion.

Do Professional Traders Rely Heavily on Indicators or Charts?

Some do, but many professionals rely more on context, liquidity, and behavior than indicators. Charts remain useful, but they are often simplified. The edge typically comes from process, risk control, and decision quality, not from stacking indicators.

How Do I Know When a Platform Is No Longer Helping My Trading?

If a tool causes hesitation, overload, or second-guessing, it may be holding you back. A helpful platform should simplify decisions and support confidence. When you notice that you trade better with less information, it is often time to reassess your setup.

Final Thoughts

TradingView works for many traders, but no platform fits everyone forever. As strategies evolve, the tools often need to change too.

Some traders need faster discovery, others need deeper execution insight, and some need a more structured way to practice and prepare.

The best alternative is the one that reduces friction in your workflow and supports how you actually make decisions.

When your platform feels like an extension of your process instead of a distraction, results tend to improve naturally.