If you are looking for TraderSync alternatives, it usually means your journaling process feels heavier than your actual trading.

TraderSync is solid, but some traders want faster tagging, cleaner analytics, or tools that sync more smoothly with their brokers and fit their workflow instead of forcing one.

Journaling should reveal mistakes and patterns, not turn into a second job.

This guide looks at broker-connected journaling platforms traders move to when they want clearer feedback, better data breakdowns, and a review process that actually improves performance instead of just storing trades.

5 Best TraderSync Alternatives

If TraderSync feels too rigid or time-consuming, these tools approach journaling in more practical ways.

Each one focuses on helping traders spot patterns, fix mistakes, and improve execution without turning review into busywork.

1. TradeZella

TradeZella is designed for traders who want clarity fast without spending hours tagging trades.

It automatically syncs with supported brokers and turns raw trade data into visual dashboards that highlight expectancy, consistency, and rule adherence.

Instead of forcing deep manual notes, it surfaces where profits come from and where discipline breaks down.

- Automatic broker sync

- Session and strategy breakdowns

- Visual performance dashboards

This structure makes post-session reviews quick and focused. Many prop firm traders prefer it because it clearly shows overtrading, sizing errors, and time-based mistakes.

TradeZella does not try to be everything. It prioritizes fast insight over endless customization, which helps traders stay consistent with journaling over time.

✅ Pros

- Very fast review workflow

- Clear visual analytics

- Minimal manual input

❌ Cons

- Limited advanced customization

2. TraderVue

TraderVue is built for traders who want depth and structure in their review process.

It allows detailed tagging of setups, mistakes, market conditions, and trade context, then filters results to isolate performance patterns.

This makes it easier to understand why certain trades work or fail over large sample sizes.

- Advanced tagging and filters

- Time-based and setup analysis

- Screenshot and note support

TraderVue rewards patience. Setup takes time, but the payoff is precise insight into execution habits and strategy behavior.

It suits traders who enjoy digging into data and refining systems slowly rather than relying on quick visual summaries.

✅ Pros

- Extremely detailed analytics

- Flexible tagging system

- Strong long-term insights

❌ Cons

- Can feel heavy at first

3. Trademetria

Trademetria focuses on statistics rather than visuals.

It emphasizes expectancy, drawdown, risk-to-reward, and consistency metrics, helping traders understand if their edge is mathematically sound.

The interface stays clean, prioritizing numbers over screenshots or commentary.

- Expectancy and risk metrics

- Consistency and drawdown tracking

- Multi-asset support

This approach appeals to traders who already know their setups and want confirmation through data.

Trademetria is often used to validate discipline and risk control rather than emotional behavior, making it popular with systematic and rule-driven traders.

✅ Pros

- Strong statistical depth

- Clean, data-first design

- Excellent risk analysis

❌ Cons

- Limited visual trade review

4. TradesViz

TradesViz offers one of the most flexible journaling environments available.

Traders can customize dashboards, build advanced tags, and analyze performance across many dimensions.

It supports a wide range of brokers and markets, which makes it appealing to multi-asset traders.

- Highly customizable dashboards

- Advanced tagging and filters

- Broad broker support

That flexibility comes with complexity. Traders willing to invest time in setup can shape the platform to match their exact workflow.

Those who prefer quick, guided reviews may find it overwhelming at first.

✅ Pros

- Extremely flexible analysis

- Wide market coverage

- Custom views per strategy

❌ Cons

- Steeper learning curve

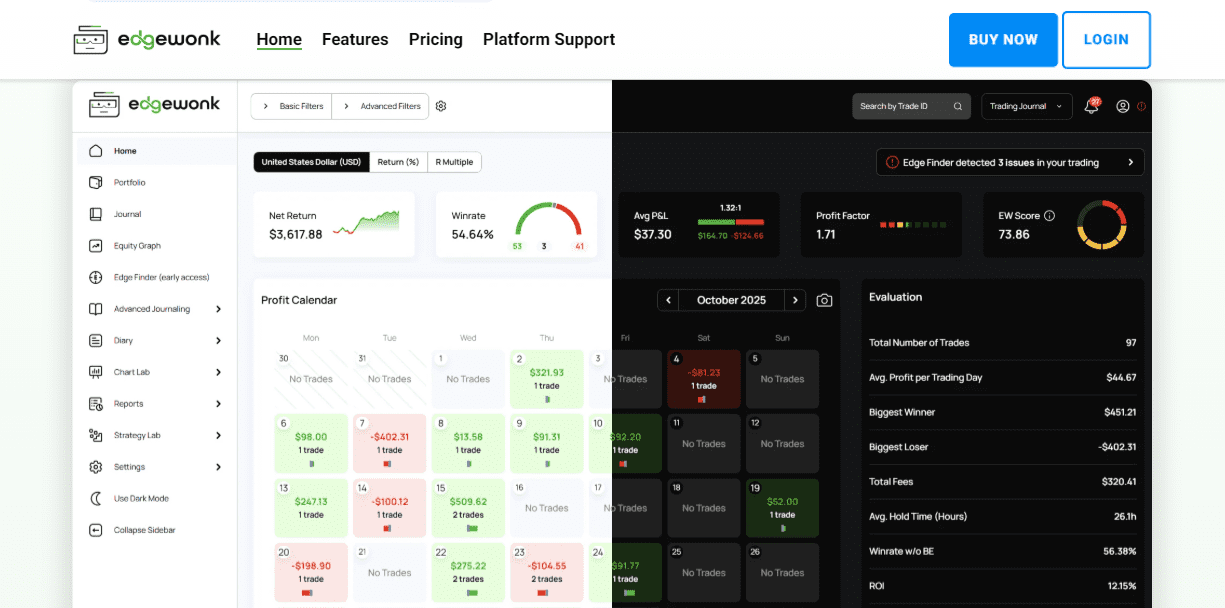

5. EdgeWonk

EdgeWonk blends performance tracking with behavioral analysis.

Traders log emotions, confidence levels, and decision quality alongside results, making it easier to connect mindset with outcomes.

The platform encourages structured reflection instead of raw data review.

- Psychology-focused trade logging

- Guided review prompts

- Behavior-performance correlation

EdgeWonk works best for traders who struggle with discipline, overtrading, or emotional mistakes.

It pushes users toward conclusions and action steps rather than passive statistics, which helps reinforce better habits over time.

✅ Pros

- Strong psychology focus

- Structured improvement process

- Encourages discipline

❌ Cons

- Less automation than newer tools

Frequently Asked Questions

How Often Should I Review My Trading Journal for It to Be Effective?

Most traders benefit from a short daily review and a deeper weekly review. Daily reviews catch execution and emotional mistakes, while weekly reviews reveal patterns across multiple trades. Long monthly reviews can help with strategy-level decisions, but consistency matters more than length.

Is Manual Journaling Better Than Automatic Broker Syncing?

Neither is objectively better. Automatic syncing saves time and reduces errors, while manual journaling forces reflection. Many traders combine both by letting trades import automatically and adding brief notes only to meaningful or problematic trades.

What Should I Track If I Feel Overwhelmed by Too Much Data?

Start with a few core metrics: entry quality, exit quality, risk management, and rule adherence. Once those are consistent, you can add more detail. Too much data too early often hides the real problems instead of solving them.

Can a Trading Journal Really Improve Performance Without Changing My Strategy?

Yes. Many performance gains come from fixing execution errors, sizing mistakes, and emotional decisions. Journaling exposes these leaks. Even with the same strategy, traders often see better results simply by becoming more disciplined and self-aware.

Conclusion

TraderSync is a solid journal, but it is not the only way to review trades effectively.

Some traders improve faster with visuals, others with raw statistics, and some by focusing on psychology and discipline.

The right alternative is the one you will actually use every day.

When journaling feels simple and useful instead of forced, it becomes a tool for progress rather than another task on your checklist.