Most trading platforms show you what price already did. Bookmap focuses on what price is reacting to right now.

This Bookmap review is written for traders who want clarity, not promises.

If you’ve ever wondered why price stalls, snaps, or reverses without warning, Bookmap is built to answer that.

It’s not beginner-friendly, and it’s not flashy, but for the right trader, it can completely change how markets make sense.

What Is Bookmap and Why Traders Use It

Bookmap is not a normal charting platform, and that’s the first thing you need to understand. It does not focus on indicators, patterns, or signals.

Instead, it shows live liquidity and order flow directly from the order book. You are not guessing where support and resistance might be. You are watching where real buy and sell orders are sitting in the market right now.

Traders use Bookmap because it answers questions that regular charts cannot.

Where are large players placing limit orders? Is price being absorbed or pushed through levels? Are buyers actually strong, or just chasing price?

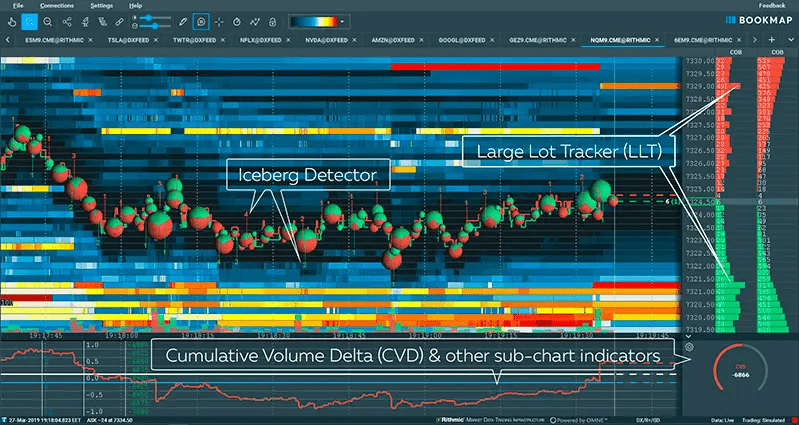

Bookmap shows this visually using heatmaps and volume bubbles, which makes it easier to see what is happening behind each candle.

This is why Bookmap is popular with futures traders, prop traders, and scalpers.

It is not about prediction. It is about seeing the auction process in real time and making better execution decisions.

How the Bookmap Heatmap Actually Works

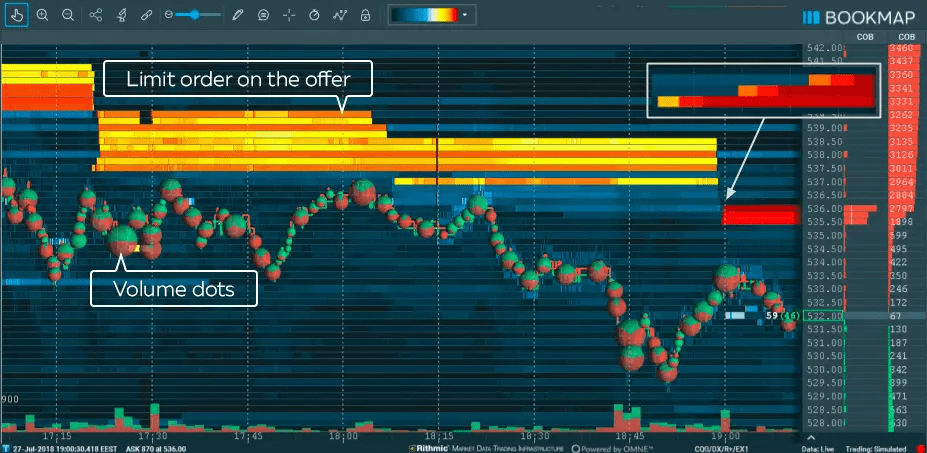

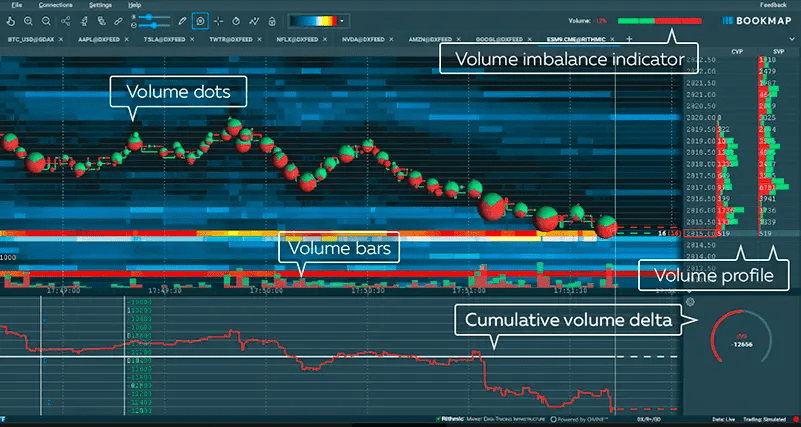

The heatmap is the core of Bookmap, and it’s what most people are really paying for.

The colors on the chart represent resting liquidity in the order book. Brighter areas mean more limit orders waiting at that price. Darker areas mean less liquidity.

As price moves, you can watch liquidity appear, disappear, or get pulled. This matters because price often reacts to these zones.

Strong liquidity can slow price down, reject it, or absorb aggressive buying or selling. When liquidity suddenly vanishes, price can move very fast.

Bookmap also shows executed trades using volume bubbles. These bubbles let you see how aggressive buyers and sellers are at each level.

What traders look for most:

- Liquidity holding price in place

- Liquidity getting eaten and price breaking through

- Absorption where large orders stop price from moving

- Thin zones where price moves quickly

This turns the chart into a live map of supply and demand instead of a guessing game.

Using Bookmap for Futures Trading

Bookmap really shines in futures markets like ES, NQ, CL, and GC. Futures have centralized order books, which means the data Bookmap uses is clean and reliable.

Many futures traders use Bookmap alongside their main trading platform. They might place trades in NinjaTrader or another platform, while using Bookmap purely for context and execution timing.

Common futures use cases include:

- Timing entries at liquidity zones instead of random candle closes

- Avoiding trades right before large liquidity walls

- Seeing when stop runs are likely to happen

- Confirming breakouts by watching liquidity disappear

This is especially useful for prop firm traders who care about drawdowns and execution quality. Bookmap helps reduce bad entries caused by chasing price or trading into heavy resistance.

Bookmap for Crypto and Other Markets

Bookmap also supports crypto markets, but this comes with some limitations.

Crypto order books are fragmented across exchanges, and liquidity behavior can change quickly. That means Bookmap is best used on high-volume pairs where order book data is more meaningful.

Crypto traders often use Bookmap to:

- Spot spoofing or fake liquidity

- Watch for absorption near key levels

- See when large players are active

- Avoid trading into obvious traps

For stocks, it’s available on higher tiers and is usually used by more advanced traders. Stock order flow can be useful, but it requires experience and proper data feeds to get value from it.

The key point is simple. Bookmap works best where order book data is strong and reliable. Futures come first, crypto second, and stocks are more advanced.

What Bookmap Is Not Good At

Bookmap is powerful, but it is not for everyone.

It does not give trade ideas, signals, or alerts telling you what to buy or sell. If you expect it to do that, you will be disappointed.

Some important limitations:

- No built-in trading strategy

- Steep learning curve for beginners

- Can feel overwhelming at first

- Requires solid understanding of order flow concepts

If you are new to trading and still learning basics like risk management or market structure, Bookmap may be too much too soon.

Many traders buy it, feel lost, and stop using it because they expected instant clarity.

Bookmap rewards patience and screen time. The more you watch it, the more patterns start to make sense. But it does require effort.

Who Should Use Bookmap and Who Should Avoid It

Bookmap makes sense for traders who already have a strategy and want better execution. It is especially useful if you trade short timeframes and care about entries and exits.

Good fit for:

- Futures scalpers and day traders

- Prop firm traders focused on consistency

- Traders who understand order flow basics

- Traders who already know what setups they trade

Not a good fit for:

- Complete beginners

- Swing traders who hold positions for weeks

- Traders looking for automated signals

- Anyone unwilling to study market behavior

Think of Bookmap as a microscope. If you do not know what you are looking for, it will not help. But if you do, it can be extremely powerful.

Frequently Asked Questions

Is Bookmap Allowed by Most Prop Firms?

Yes, Bookmap is generally allowed by most prop firms because it does not execute trades or automate decisions. It is a visual analysis tool only. However, some firms restrict certain data feeds or add-ons, so traders should always check the firm’s platform and data rules before using it live.

Can Bookmap Be Used Together With TradingView or NinjaTrader?

Yes, many traders run Bookmap alongside TradingView or NinjaTrader. Bookmap is usually kept on a second screen for order-flow context, while trades are executed on the main platform. This setup helps traders combine structure-based analysis with real-time liquidity insight.

Does Bookmap Work Well During Low-Volume Market Hours?

Bookmap is less effective during low-volume periods like holidays or overnight sessions. Liquidity becomes thinner and less reliable, which can lead to misleading signals. Most traders get the best results during high-volume sessions such as the New York open or major economic releases.

Is Bookmap Useful for Long-Term or Swing Trading?

Bookmap is not designed for long-term trading. Swing traders may use it occasionally to fine-tune entries, but its real value comes from short-term execution. The tool focuses on immediate order-flow behavior, which matters most for intraday and short-duration trades.

Conclusion

Bookmap is not a shortcut, and it is not a signal machine. It’s a visibility tool that rewards traders who already take execution seriously.

If you trade futures, scalp, or work with prop firm rules, Bookmap can give you an edge by showing real liquidity and real pressure, not guesses.

It takes time to learn and patience to use properly. But once it clicks, it’s hard to go back to trading without seeing what’s actually happening.