Most traders don’t fail because of bad strategies.

They fail because they never truly test them. Forex Tester Online is built for traders who want to practice, test, and make mistakes without losing real money.

This review looks at Forex Tester Online as a learning and validation tool, not a magic solution. If you’ve ever asked yourself whether your strategy actually works or just got lucky, this platform is meant to answer that question.

What Is Forex Tester Online and What Problem It Solves

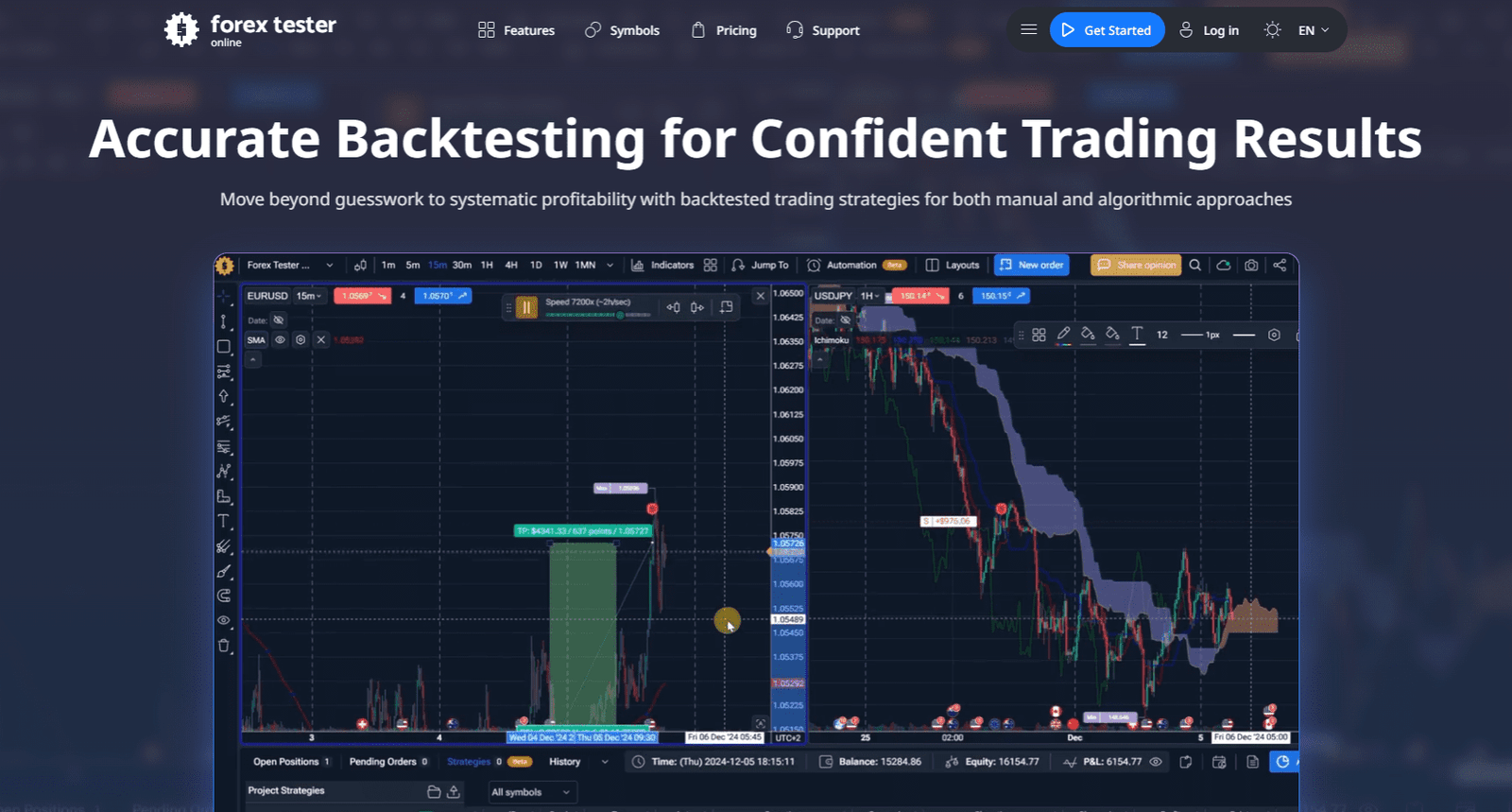

Forex Tester Online is a browser-based trading simulator that lets you replay historical market data and trade it as if it were live.

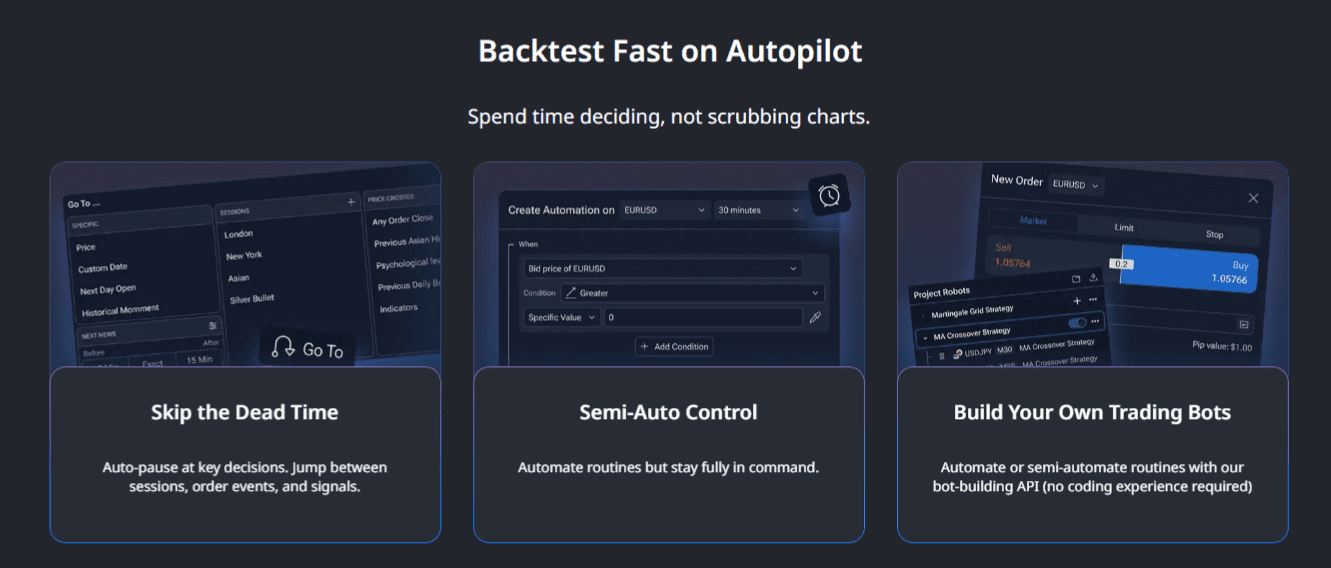

The main goal is simple. You test strategies in realistic market conditions without risking capital. Unlike demo accounts, you are not limited by live market hours.

You can replay months or years of price action in a single session.

This matters because most traders cannot sit in front of charts all day. Forex Tester Online allows focused practice.

You can test entries, exits, stop placement, and risk management at your own pace. It is especially useful for traders who want to build confidence before trading live or refine a strategy that feels inconsistent.

It does not promise profits. It promises repetition, feedback, and structure. That alone puts it in a different category than most trading tools.

How the Market Replay Feature Actually Feels

The replay feature is the heart of Forex Tester Online. You select an asset, choose a time period, and move forward candle by candle or at adjustable speeds.

This creates a realistic trading flow where you must make decisions without knowing what happens next.

What makes it useful is the pressure simulation. You still need to decide when to enter, when to exit, and when to stay out.

You see wins and losses play out in sequence, which exposes emotional habits that paper backtests never reveal.

Many traders discover issues like:

- Entering too early out of boredom

- Moving stop losses unnecessarily

- Closing winners too fast

- Overtrading during flat markets

These lessons are difficult to learn from charts alone. Replaying markets forces honesty.

Who Forex Tester Online Is Best Suited For

FTO works best for traders who are serious about improvement, not shortcuts. It is especially useful if you already have a basic strategy and want to see if it holds up over time.

Good fit for:

- Forex traders building rule-based systems

- Traders preparing to go live for the first time

- Traders fixing consistency issues

- Traders testing risk and position sizing rules

Not ideal for:

- Traders looking for trade signals

- Fully automated system developers

- Long-term investors

- Traders unwilling to journal or review results

This tool rewards discipline. If you rush through testing or ignore results, it loses value quickly.

Strategy Testing and Data Depth

One of the biggest strengths of Forex Tester Online is access to deep historical data.

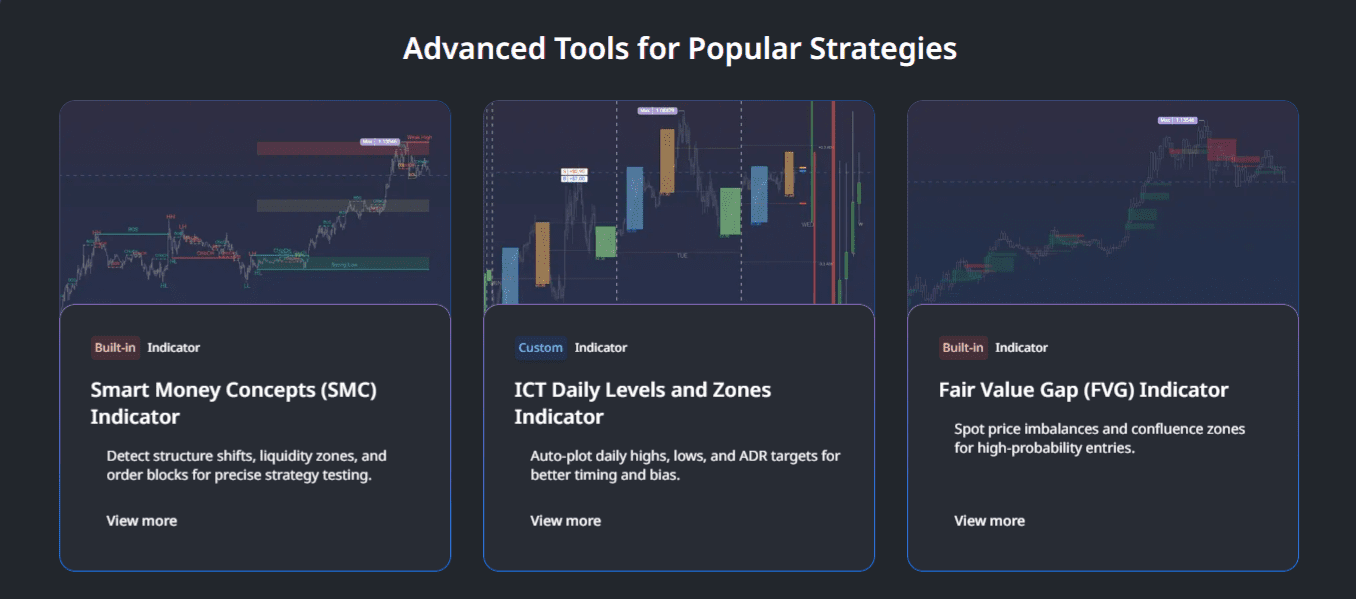

You can test strategies across different market conditions, including trends, ranges, high volatility, and low liquidity periods.

This matters because many strategies only work in specific environments. Testing over long periods helps you understand when to trade and when not to trade.

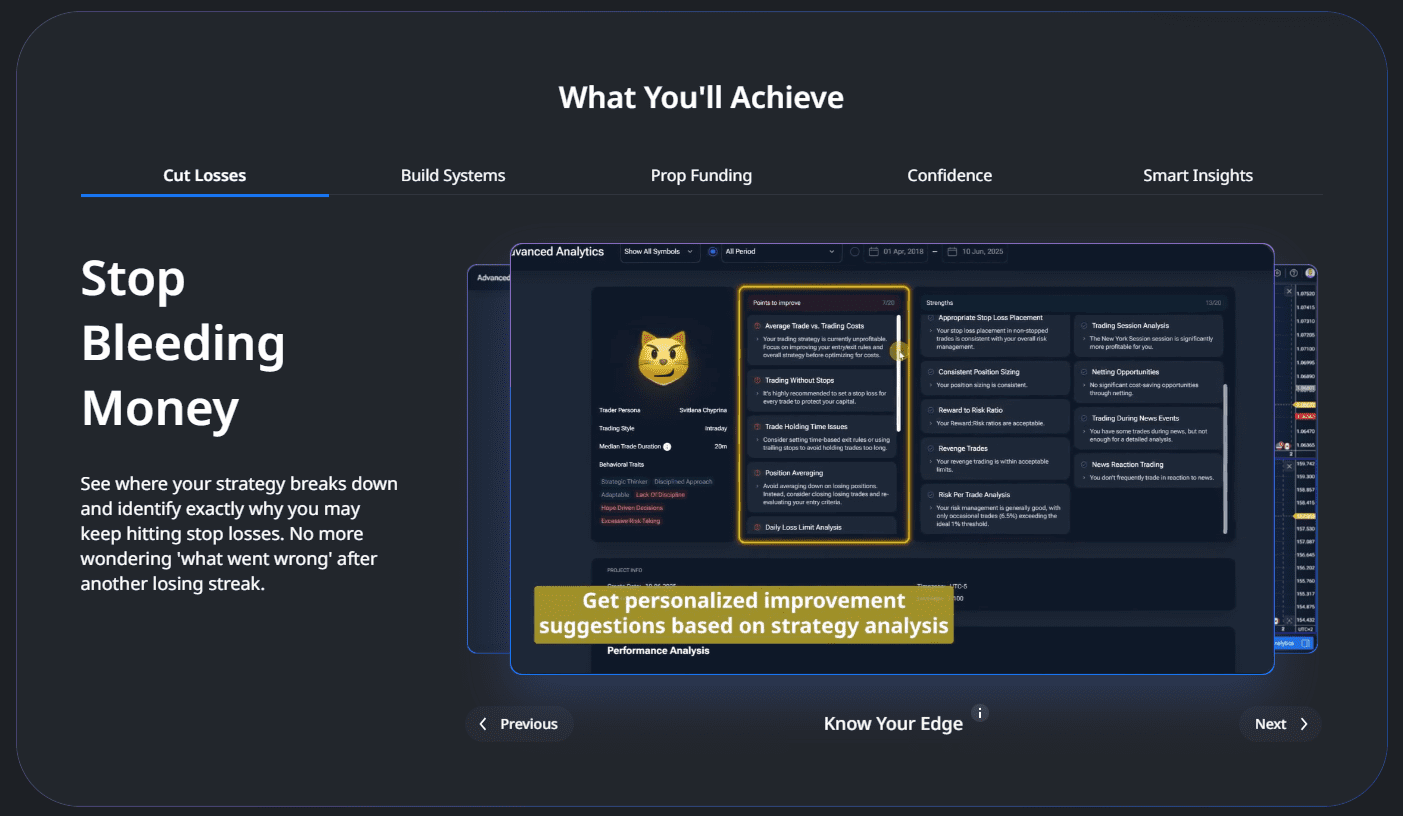

You can track performance metrics such as:

- Win rate

- Drawdown

- Risk-to-reward consistency

- Trade frequency

- Equity curve behavior

Instead of guessing whether a strategy is “good,” you get evidence. That alone can save traders months of frustration.

Learning Curve and Ease of Use

Forex Tester Online is easier to learn than most professional trading tools. The interface is clean and focused on the testing process.

You don’t need advanced technical knowledge to start using it.

That said, meaningful results require structure. Traders who treat it like a game often miss the point. The platform works best when combined with:

- A written trading plan

- Clear entry and exit rules

- Consistent position sizing

- A trading journal

The tool does not enforce discipline. You must bring that yourself.

What Forex Tester Online Does Not Do

Forex Tester Online is not a replacement for live trading.

It cannot fully replicate slippage, spreads during news, or psychological pressure tied to real money. It also does not teach strategy logic or market theory.

Important limitations:

- No guaranteed real-market performance

- Emotional pressure is reduced

- Requires honest self-review

- No automated strategy optimization

Understanding these limits helps set realistic expectations. Used correctly, it supports growth. Used incorrectly, it becomes just another unused subscription.

Frequently Asked Questions

Does Forex Tester Online Support Assets Beyond Forex Pairs?

Yes, Forex Tester Online supports more than just forex. Depending on the plan, traders can test indices, commodities, and some crypto instruments. However, its strongest use case remains forex, where historical data quality and testing precision are most reliable.

Can I Import My Own Strategies or Indicators Into Forex Tester Online?

Forex Tester Online does not support custom indicator coding like desktop testing platforms. It focuses on manual strategy testing using built-in tools. This makes it better suited for discretionary traders rather than developers working on complex automated systems.

How Realistic Are Spreads and Execution in Forex Tester Online?

Spreads and execution are simulated based on historical conditions, but they cannot perfectly match live market behavior. Slippage, latency, and extreme spread widening during news events are simplified. The platform is best for decision-making practice, not execution fine-tuning.

Is Forex Tester Online Useful for Funded Account Preparation?

Yes, many traders use Forex Tester Online to prepare for funded challenges. It helps build rule consistency, discipline, and confidence before risking real capital. While it cannot replicate emotional pressure exactly, it does help traders reduce costly mistakes during evaluations.

Conclusion

Forex Tester Online is built for traders who want proof, not opinions. It won’t tell you what to trade, but it will show you how you trade.

If you are willing to test honestly and review your results, it can shorten the learning curve significantly.

It’s not exciting, but it is effective. And for many traders, that matters far more than fancy tools or bold promises.