Forex trading statistics offer a clear look behind one of the most talked-about financial markets in the world.

With trillions of dollars moving through the forex market each day, it’s often portrayed as a place of endless opportunity, speed, and accessibility. Yet the numbers tell a more grounded story.

Beyond the headlines and social media claims, forex is a market dominated by institutions, shaped by global liquidity, and unforgiving to traders who underestimate its complexity.

From trading volume and participant makeup to profitability rates and platform usage, these figures provide essential context for anyone looking to understand forex beyond surface-level hype.

Top Forex Trading Statistics

- The global forex market averages ~$9.6 trillion in daily trading volume

- Forex is the largest financial market in the world, exceeding equities and futures combined

- The U.S. dollar is involved in about 88–89% of all forex trades

- Retail traders account for roughly 5–6% of total global forex volume

- An estimated 13–15 million retail traders participate worldwide

- Between 68% and 85% of retail forex traders lose money

- Only 10–15% of traders remain profitable after one year

- EUR/USD is the most traded currency pair, representing about 23% of total volume

- MetaTrader platforms dominate retail trading, used by over half of retail traders

The Size of the Global Forex Market

The forex market’s scale is unmatched across global finance. Its size, liquidity, and constant activity form the foundation of price discovery and explain why currencies remain highly responsive to global economic events.

Daily Trading Volume and Liquidity

According to the Bank for International Settlements (BIS), average daily forex trading volume reached approximately $9.6 trillion in April 2025, based on preliminary results from the latest Triennial Central Bank Survey.

This represents a significant increase from previous survey periods and reinforces forex’s position as the most liquid financial market in the world.

Most of this activity is concentrated in a small group of major currencies, which helps keep spreads tight and execution efficient for heavily traded pairs.

How the Forex Market Operates

Forex trading takes place in an over-the-counter (OTC) market rather than on a centralized exchange. Transactions occur through a global network of banks, financial institutions, brokers, and liquidity providers.

The market operates 24 hours a day, five days a week, moving through major trading centers in Asia, Europe, and North America.

Who Participates in Forex Trading?

Forex trading is dominated by large financial institutions. Major banks, hedge funds, asset managers, corporations, and central banks account for the vast majority of global volume.

Retail traders represent only a small slice of activity. Industry research estimates that retail participation accounts for around 5–6% of total daily forex turnover, despite millions of individual traders worldwide.

This imbalance explains why market pricing is largely driven by institutional flows rather than individual speculation.

How Many People Trade Forex?

Estimating the exact number of forex traders is difficult due to the market’s decentralized nature. However, multiple industry analyses suggest there are approximately 13 to 15 million active retail forex traders globally.

Participation has expanded significantly over the past decade due to online brokers, mobile trading platforms, and lower barriers to entry.

Growth has been especially notable in regions such as Asia, Eastern Europe, and parts of Africa, where access to global markets has increased rapidly.

Forex Trader Profitability Statistics

Despite its size and accessibility, forex trading remains difficult for most retail participants.

Regulated brokers in regions such as the EU and UK are required to publish client loss disclosures. These consistently show that between 68% and 85% of retail traders lose money over time.

Long-term success is even rarer. Studies and broker data indicate that only 10–15% of traders remain profitable after one year, with profitability rates declining further over longer periods.

The most common causes of losses include excessive leverage, poor risk management, emotional decision-making, and unrealistic expectations.

Most Traded Currencies and Pairs

Trading activity in forex is highly concentrated. A small group of currencies accounts for the majority of global volume.

The U.S. dollar appears on one side of approximately 88% of all forex transactions, reflecting its role as the world’s primary reserve currency.

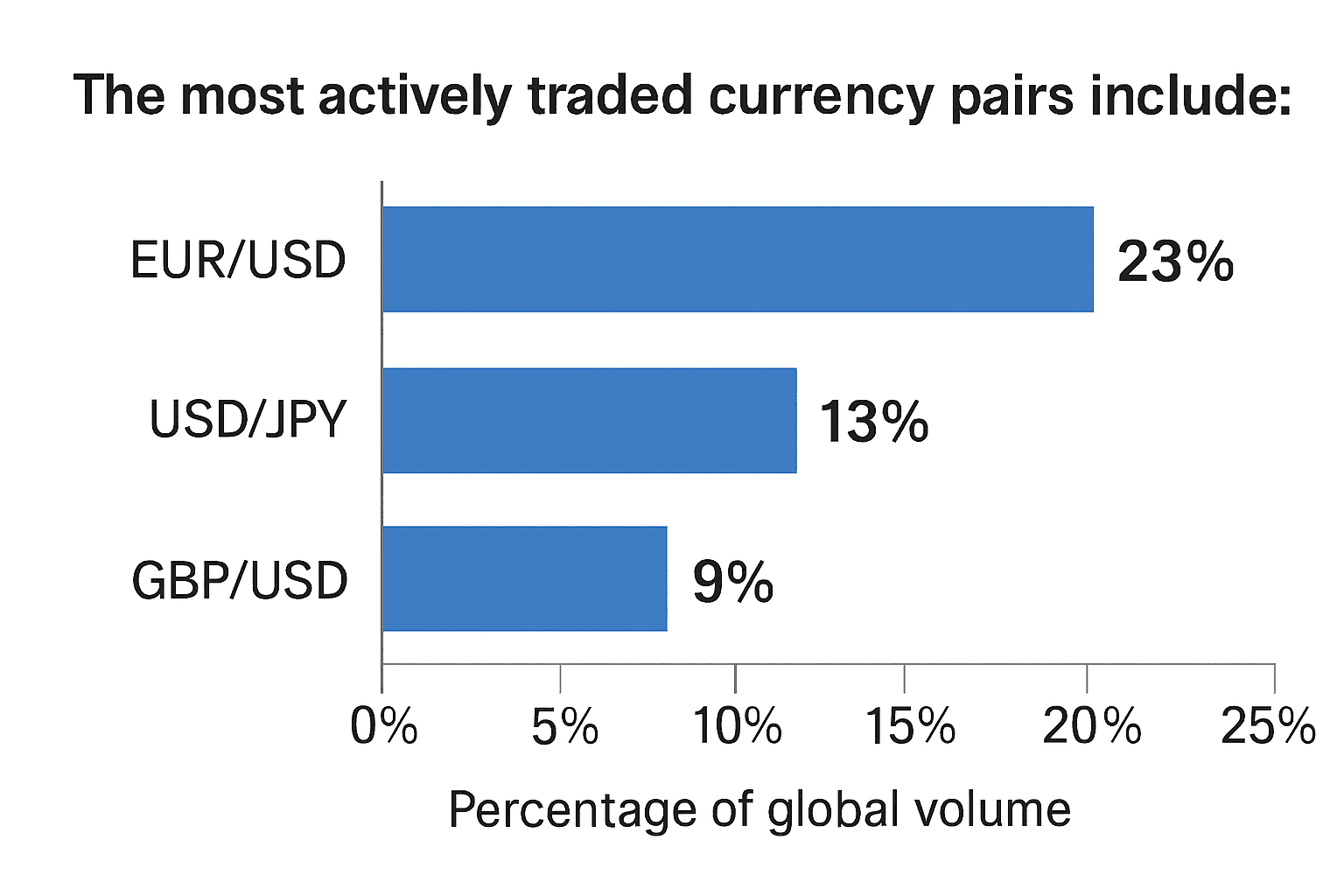

The most actively traded currency pairs include:

- EUR/USD – around 23% of global volume

- USD/JPY – roughly 13%

- GBP/USD – approximately 9%

These pairs are favored due to their liquidity, tight spreads, and consistent trading activity.

Retail Trading Platforms and Tools

Technology plays a central role in retail forex trading. Most retail traders access the market through third-party trading platforms rather than institutional systems.

MetaTrader platforms dominate this space. MetaTrader 4 and MetaTrader 5 together account for over half of retail forex platform usage worldwide, according to broker and platform adoption data.

Popular tools among retail traders include technical indicators such as moving averages, RSI, MACD, and Fibonacci retracements.

However, research suggests that traders using simpler, rule-based approaches tend to perform better than those relying on excessive indicators.

Conclusion

The statistics highlight a clear contrast between the scale of the forex market and the outcomes experienced by most retail traders.

While forex offers unmatched liquidity and global access, it is largely controlled by institutions with significant capital and advanced infrastructure.

For individuals, success depends less on market size and more on discipline, risk control, and realistic expectations.

The data consistently shows that without these, most traders struggle to achieve sustainable results.

Frequently Asked Questions

How Big Is the Forex Market Compared to Stocks?

Forex is significantly larger. Daily forex volume exceeds global equity trading volume by several multiples.

What Percentage of Forex Traders Lose Money?

Most regulated broker disclosures show that roughly 70–85% of retail traders lose money.

Is Forex Trading Mostly Retail or Institutional?

Forex is overwhelmingly institutional. Retail traders account for only about 5–6% of total volume.

What Is the Most Traded Currency Pair?

EUR/USD is the most traded forex pair globally.