GoCharting is a capable charting platform, but many traders reach a point where its workflow, data depth, or testing flexibility starts to feel limiting.

That moment usually arrives after missed entries, unclear liquidity zones, or strategies that looked great on charts but failed in real execution. This is where specialized tools step in.

The best GoCharting alternatives do not try to replicate everything in one interface. Instead, they focus on clarity, precision, and decision-making advantage. Some excel at order flow, others at automation, backtesting realism, or real-time scanning.

This guide breaks down the strongest GoCharting alternatives and explains exactly why traders move to them and how each one fits a specific trading style.

Best GoCharting Alternatives for Serious Traders

GoCharting covers multiple use cases, but it rarely goes deep in one area. The platforms below are designed to solve very specific trading problems, not to be generic charting tools.

1. Bookmap

Bookmap is built for traders who want to understand market liquidity, order flow, and execution behavior, not just price patterns. Instead of traditional candlesticks, Bookmap uses a heatmap that displays historical and real-time limit orders directly on the chart.

This allows traders to see where liquidity stacks, where it gets pulled, and how price reacts around key zones. Compared to GoCharting, Bookmap offers a far deeper view into what drives price movement beneath the surface.

Large resting orders, absorption zones, and liquidity traps become visible in real time. This is especially valuable for futures, crypto, and short-term trading where execution timing matters more than indicator signals.

Traders often switch to Bookmap after realizing that indicators alone cannot explain sudden reversals or failed breakouts.

The trade-off is complexity. Bookmap has a steeper learning curve and focuses more on execution insight than traditional chart studies. For traders willing to invest time, it delivers information GoCharting simply cannot show.

2. TrendSpider

TrendSpider takes the opposite approach. Instead of giving more raw data, it focuses on automation and consistency. The platform automatically draws trendlines, support and resistance levels, and patterns across multiple timeframes.

This removes a large amount of subjectivity that exists in manual charting. One of TrendSpider’s strongest advantages over GoCharting is its strategy testing workflow.

Traders can test ideas using historical data without coding, then refine those strategies using multi-timeframe confirmation. Automated alerts and scans ensure setups are not missed during fast markets.

TrendSpider works best for swing traders and systematic traders who want repeatable analysis instead of discretionary chart drawing.

It does not offer order book depth like Bookmap, but it significantly improves efficiency and discipline compared to GoCharting’s more manual process.

3. Trade Ideas

Trade Ideas is not a traditional charting platform. Its strength lies in real-time opportunity detection. The platform continuously scans the market using AI-driven models, including its well-known Holly AI, to surface stocks showing unusual momentum, volatility, or structural behavior.

Compared to GoCharting, Trade Ideas shifts the focus away from chart building and toward idea generation. Traders who struggle with what to trade often benefit the most.

Instead of scrolling through charts, the platform delivers ranked opportunities based on statistical edge and historical performance.

Trade Ideas fits active day traders and momentum traders who need speed and adaptability. It does not replace deep charting tools, but it complements them well. Many traders pair Trade Ideas with TradingView or Bookmap to analyze execution after signals appear.

4. TradingView

TradingView is one of the most widely used charting platforms in the world, and for good reason. It combines flexible charting, a massive indicator library, and community-driven scripts in one accessible interface.

Compared to GoCharting, TradingView offers broader customization and easier integration with brokers. A major advantage is its ecosystem.

Thousands of user-created indicators and strategies allow traders to test ideas quickly without building tools from scratch. Multi-chart layouts, alerts, and cloud-based access make TradingView suitable for traders managing multiple markets at once.

TradingView does not specialize in order flow or deep backtesting simulation, but it provides a strong foundation for analysis.

Many traders use it as their primary charting tool while relying on specialized platforms for execution or testing.

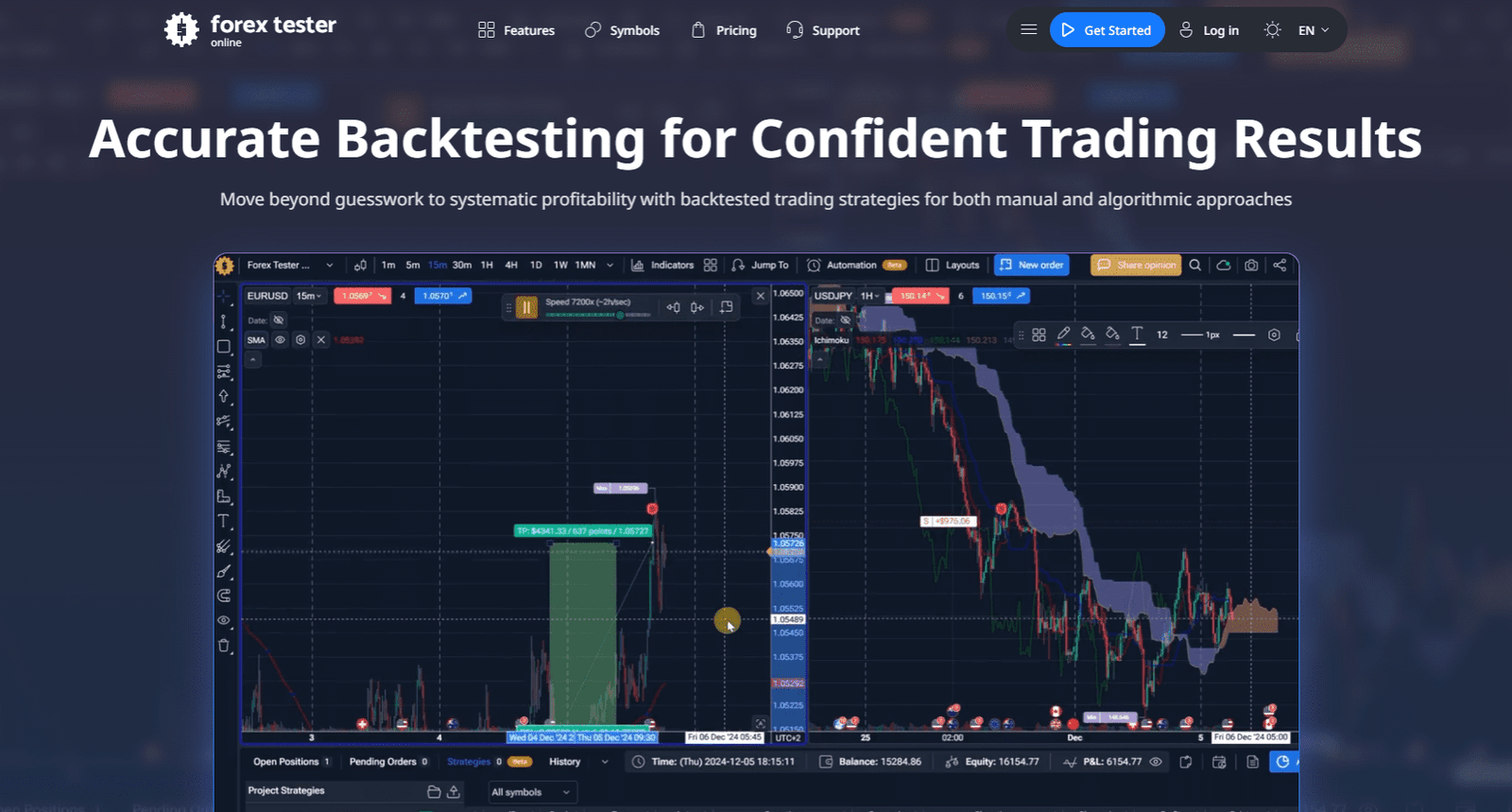

5. Forex Tester Online

Forex Tester Online is designed for one purpose: accurate and realistic backtesting. It allows traders to replay historical markets candle by candle, place trades manually, and track performance as if trading live.

This solves a major weakness in GoCharting, which lacks execution-level simulation. The platform supports detailed statistics, session-based analysis, and trade journaling.

This makes it ideal for traders who want to validate strategies before risking capital. Manual traders benefit especially, as they can practice decision-making under realistic conditions.

Forex Tester Online focuses on learning and validation rather than real-time trading. It is best used as a preparation tool that builds confidence and discipline before applying strategies in live markets.

How These Platforms Compare to GoCharting in Real Trading

GoCharting provides decent charting and indicator access, but it operates in the middle ground. Bookmap goes deeper into execution mechanics.

TrendSpider removes analysis subjectivity through automation. Trade Ideas excels at discovering opportunities in real time.

TradingView offers flexibility and scale. Forex Tester Online focuses on historical accuracy and skill development.

The key difference lies in specialization. GoCharting attempts to cover many functions at once. The alternatives succeed by solving specific trading problems with clarity and depth.

Traders often move away after realizing that better decisions come through focused tools, not broader feature lists.

Key Factors to Consider When Choosing a GoCharting Alternative

Selecting the right platform starts with understanding how decisions are made.

Data depth and transparency matter for execution-focused traders. Order flow tools reveal intent that indicators cannot show.

Backtesting realism is critical for strategy development. Testing that ignores spreads, slippage, or execution timing leads to false confidence.

Automation and alerts improve consistency. Platforms that reduce manual chart work help traders follow rules more reliably.

Learning curve and workflow fit influence long-term use. A powerful tool that disrupts decision flow often gets abandoned.

Market coverage should align with traded instruments. Some platforms excel in stocks, others in futures or forex.

Frequently Asked Questions

What Is the Best GoCharting Alternative for Order Flow Trading?

Bookmap is the strongest choice for order flow analysis. Its liquidity heatmaps and real-time order book visualization reveal market behavior that traditional charts cannot show. This makes it especially effective for execution-focused traders.

Which GoCharting Alternative Works Best for Strategy Testing?

Forex Tester Online offers the most realistic manual backtesting environment. TrendSpider is also strong for automated strategy testing and multi-timeframe analysis. The choice depends on manual versus systematic trading style.

Can TradingView Fully Replace GoCharting?

TradingView can replace GoCharting for charting and indicator-based analysis. It does not replace execution-level insight or advanced simulation. Many traders use it as a core platform alongside specialized tools.

Are These GoCharting Alternatives Beginner Friendly?

TradingView and Forex Tester Online are the easiest starting points. Bookmap and Trade Ideas require more learning but deliver deeper insight once mastered. Skill level and goals should guide the choice.

Conclusion

GoCharting is not a weak platform, but trading evolves faster than generic tools. The best GoCharting alternatives exist because traders demand clarity, precision, and confidence in different parts of the trading process.

Bookmap exposes the mechanics behind price movement. TrendSpider enforces disciplined analysis. Trade Ideas delivers opportunities at speed.

TradingView offers unmatched flexibility. Forex Tester Online builds skill through realistic practice. The real edge does not come from using more tools.

It comes from using the right one for the right decision. When a platform aligns with how trades are planned, executed, and reviewed, results improve naturally.