Olymptrade is often marketed as a simple way to get started with online trading. Its interface, low entry requirements, and built-in learning tools make it appealing to beginners, especially those placing short-term trades.

At the same time, traders who spend more time on the platform often begin to notice its limitations.

While Olymptrade offers accessibility and structure, it can feel restrictive once traders look for deeper analysis, broader market flexibility, or more control over execution.

This Olymptrade review takes a closer look at how the platform works, where it performs well, and where it starts to fall short, especially when compared to more advanced alternatives.

What Is Olymptrade?

Olymptrade is an online trading platform that allows users to trade short-term contracts and selected market instruments through a proprietary web and mobile interface.

It positions itself as a regulated and accessible broker, focusing heavily on ease of use and guided trading.

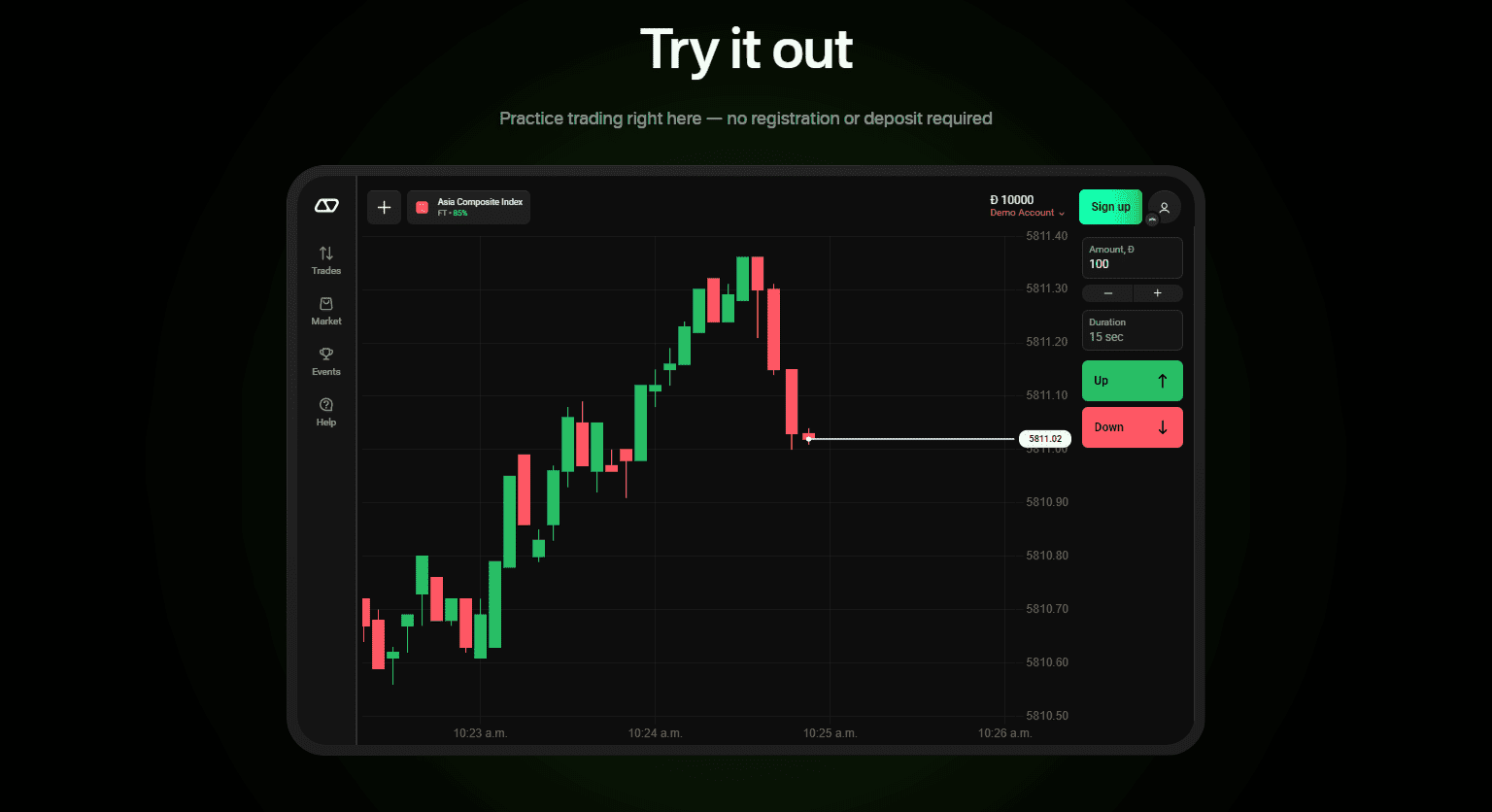

The platform supports a demo account, low minimum deposits, and a simplified trading process. Users choose an asset, set the trade amount and duration, and place an up or down trade based on price direction.

Olymptrade does not offer direct market access or advanced execution controls. Instead, it operates as a closed trading environment designed to reduce complexity, which can be helpful for beginners but limiting for experienced traders.

How Trading Works on Olymptrade

Olymptrade’s trading process is intentionally straightforward.

Traders select an asset, choose a trade amount, set a duration, and decide whether the price will move up or down. Trade durations can be very short, which makes the platform popular among users interested in fast results.

While this simplicity lowers the learning curve, it also removes flexibility. There is little room for advanced order types, deeper market structure analysis, or customized execution logic. Traders are largely limited to what the platform allows within its predefined system.

For users who want a guided, controlled experience, this can feel reassuring. For others, it quickly becomes restrictive.

Platform Interface and Usability

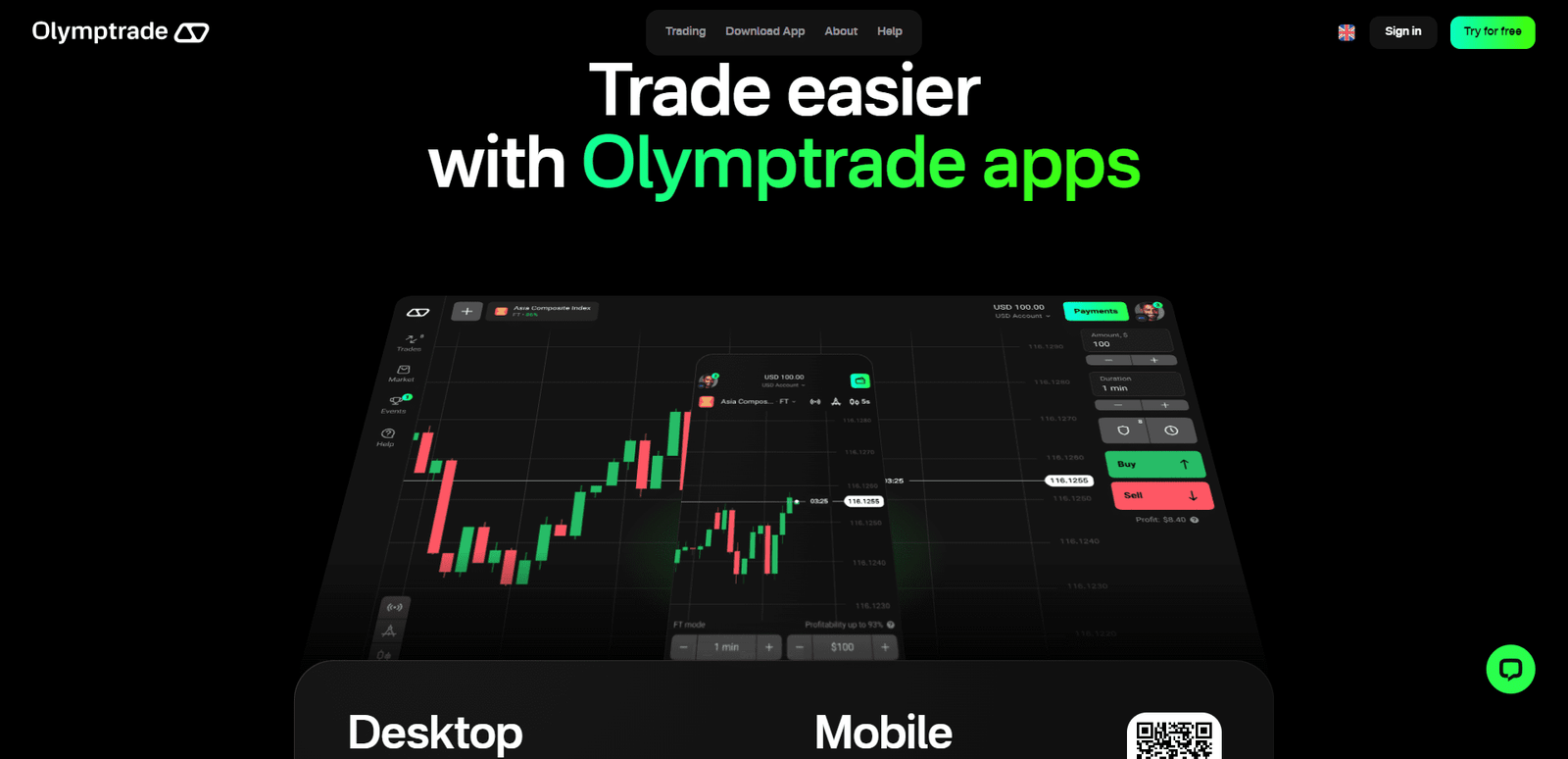

Olymptrade’s interface is clean, modern, and clearly designed for ease of navigation. Charts are visually simple, buttons are clearly labeled, and the overall layout avoids clutter.

However, the charting tools themselves are relatively basic. While some indicators and drawing tools are available, they lack the depth and customization found on more advanced platforms.

Traders who rely on multi-timeframe analysis or complex indicator setups may find the tools insufficient.

The platform works smoothly on both desktop and mobile, but performance consistency does not fully compensate for the lack of analytical depth.

Demo Account and Learning Resources

One of Olymptrade’s strongest areas is onboarding.

The demo account allows users to practice without risk, and the platform includes learning materials, tutorials, and in-app guidance. These resources are helpful for traders who are new to trading concepts and want structured explanations.

That said, the educational content tends to focus more on platform usage than on advanced strategy development.

Traders looking to refine complex trading systems or build data-driven strategies will likely outgrow these materials quickly.

Olymptrade works well as an introduction, but it does not scale particularly well with experience.

Risk Management and Trade Control

Olymptrade includes basic risk management features such as predefined trade amounts and clear outcome visibility before placing trades.

Negative balance protection and insured deposits add a layer of safety, especially for new users. However, risk control options remain limited compared to platforms that allow more detailed position sizing, stop-loss customization, or partial exits.

Because trades are largely fixed once placed, traders have less control over managing positions dynamically. This can be frustrating for users who want to adapt trades in response to market movement.

Where Olymptrade Falls Short

Despite its accessibility, Olymptrade has clear limitations.

The platform’s closed ecosystem restricts advanced trading techniques. Charting tools are basic, execution options are fixed, and strategy flexibility is limited. As traders gain experience, these constraints become more noticeable.

Additionally, while trading signals and ready-to-use strategies are promoted, they should not be viewed as a substitute for independent analysis. Relying too heavily on built-in signals can create false confidence without long-term consistency.

Olymptrade works best as a starting point, not a long-term trading solution.

Olymptrade Review Verdict: Is It Worth Using?

Olymptrade is a legitimate and accessible platform that serves its intended audience well, beginner traders who want simplicity, guidance, and low entry requirements.

However, it struggles to meet the needs of traders who want deeper analysis, greater flexibility, and more control over execution.

As experience grows, many users begin looking for platforms that offer stronger tools and broader capabilities.

For traders serious about improving long-term performance, Olymptrade often feels like a stepping stone rather than a destination.

Better Alternatives: IQ Option and Exnova

For traders looking to move beyond Olymptrade’s limitations, IQ Option stands out as the strongest alternative.

It offers significantly more advanced charting, technical indicators, and multi-asset access within a single proprietary platform. The analytical depth alone makes it better suited for traders focused on strategy development.

Close behind is Exnova, which maintains a clean and accessible interface while offering more flexibility than Olymptrade. It provides a smoother transition for traders who want simplicity without feeling boxed in.

Both platforms address many of the limitations found in Olymptrade while still remaining approachable.

Frequently Asked Questions

Is Olymptrade Suitable for Complete Beginners?

Yes. Olymptrade is designed with beginners in mind and offers a demo account and guided learning materials.

Does Olymptrade Offer Advanced Trading Tools?

Not really. While basic indicators are available, the platform lacks advanced charting and execution flexibility.

Can Olymptrade Be Used for Long-Term Trading Strategies?

It is possible, but the platform’s structure is better suited to short-term, simple trades rather than complex strategies.

Conclusion

This Olymptrade review shows a platform designed to make trading accessible and unintimidating. It succeeds in onboarding new traders and providing a controlled environment for learning.

At the same time, its simplified structure limits growth. Traders who want to analyze markets more deeply or build adaptable strategies will likely outgrow the platform.

For those traders, moving to more capable alternatives like IQ Option or Exnova is a natural next step.