Trading journals have become a common tool for traders who want more control over their decision-making and long-term performance.

Rather than relying on memory or rough notes, many traders now use dedicated platforms to organize trades, measure risk, and understand what actually drives results.

Trademetria positions itself as one of those tools, focusing on turning raw trading data into clear, usable insights.

This review looks at how Trademetria works, what it offers, and how it fits into a trader’s workflow, based solely on what is visible in the platform and its published materials.

What Is Trademetria?

Trademetria is a trading journal and analytics platform designed for traders and investors who want to track, analyze, and improve their performance.

The platform centers around logging trades, visualizing results, and identifying behavioral and statistical patterns over time.

Rather than positioning itself as a shortcut or automated trading solution, Trademetria presents itself as a decision-support tool.

Its purpose is to help users review what they’ve already done in the market and use that information to trade with more structure and consistency going forward.

How Trademetria Works

The core workflow in Trademetria starts with trade data. Users can import trades or enter them manually, after which the platform organizes that information into dashboards, reports, and charts.

From there, performance metrics are calculated and displayed in a way that emphasizes clarity rather than complexity.

Once trades are logged, Trademetria allows users to filter and group them by date, instrument, strategy, execution type, or other attributes.

This makes it easier to isolate specific behaviors, time periods, or setups and see how they performed relative to the rest of the trading history.

The platform is designed to be ongoing rather than episodic. Instead of one-time analysis, it encourages regular review so traders can track progress, habits, and consistency over time.

Trading Journal and Performance Tracking

At the center of Trademetria is its journaling system. Each trade becomes part of a larger record that includes entry and exit data, position size, outcomes, and contextual notes.

Over time, this creates a detailed trading history that can be reviewed at both a high level and a granular level.

Performance statistics are displayed clearly, including profit and loss figures, win rates, drawdowns, and profit factors. These metrics are not presented in isolation but as part of a broader picture that shows how results evolve across sessions, instruments, or strategies.

This approach supports traders who want to move beyond single trades and focus on repeatability. Instead of asking whether a trade was “good” or “bad,” the platform makes it easier to see whether a process is working over many repetitions.

Risk Management and Discipline Tools

Risk management is a recurring theme throughout Trademetria’s interface. The platform highlights drawdowns, position sizing, and risk exposure in a way that encourages early awareness rather than post-loss analysis.

By reviewing exits, stops, and risk-to-reward ratios, users can see patterns in how losses and winners are handled. This helps identify issues such as cutting winners too early, letting losses run, or deviating from predefined risk rules.

The emphasis on discipline is reinforced through habit tracking and review features. Trademetria positions discipline as something that can be measured and improved, rather than treated as an abstract concept.

Analytics, Insights, and Visual Reporting

Trademetria places a strong focus on visual analysis. Charts, graphs, and summaries are used to show what is working and what is not, without requiring users to manually calculate statistics.

The platform presents insights that highlight timing, execution quality, and trade duration. By visualizing entries and exits directly on charts, users can connect outcomes to market behavior rather than reviewing numbers in isolation.

These analytics are designed to support reflection rather than automation. The platform does not trade on the user’s behalf but instead provides information that traders can use to refine their own decisions.

Pricing Overview

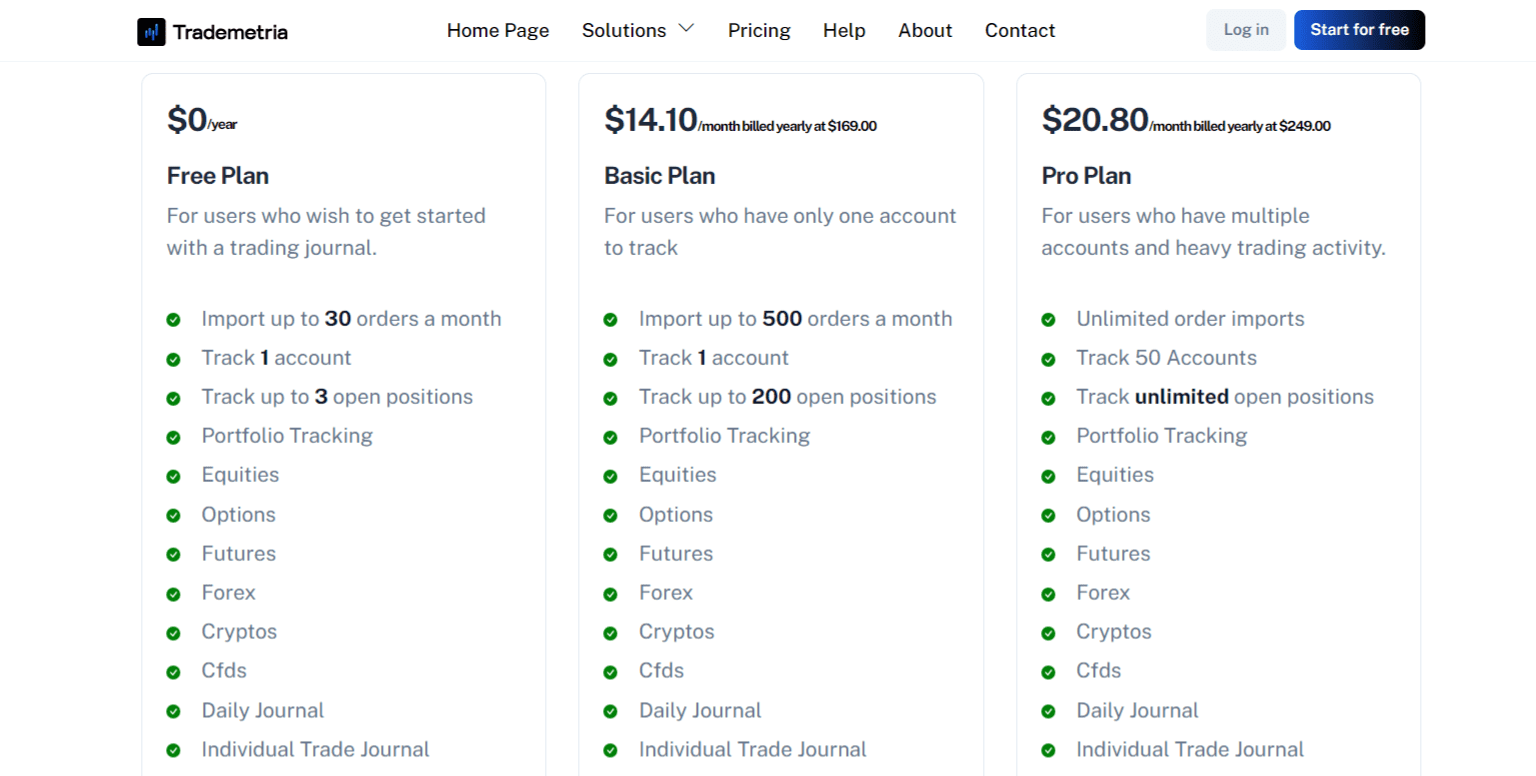

Trademetria offers multiple pricing tiers designed to accommodate different levels of trading activity. There is a free plan for users who want to get started with basic journaling features, alongside paid plans that expand limits and functionality.

Paid plans increase the number of trades that can be tracked, the number of accounts supported, and access to more advanced analytics and customization options.

Pricing is structured with both monthly and yearly options, allowing users to choose based on preference and commitment level.

The pricing model aligns with the platform’s positioning as a professional tool rather than a one-time purchase.

Who Trademetria Is Designed For

Trademetria is best suited for traders who value structure, review, and long-term improvement. It fits users who are willing to log trades consistently and spend time analyzing results rather than relying on intuition alone.

The platform is particularly relevant for traders who want to improve discipline, refine risk management, and understand performance patterns across many trades.

Those who already review their trading data manually may find Trademetria useful for centralizing and visualizing that process.

It is less focused on automation and more on accountability, making it a better fit for traders who want to stay actively involved in their decision-making.

Frequently Asked Questions

What Is the Main Purpose of Trademetria?

Trademetria is designed to help traders track trades, analyze performance, and improve discipline through structured journaling and analytics.

Does Trademetria Place Trades Automatically?

No. Trademetria focuses on recording and analyzing trades rather than executing them.

Can Trademetria Be Used Across Different Markets?

Yes. The platform supports tracking activity across multiple markets and instruments in one place.

Is Trademetria Suitable for Long-Term Improvement?

The platform is built around ongoing review and habit tracking, making it suitable for traders focused on consistency over time.

Conclusion

Trademetria presents itself as a comprehensive trading journal and analytics platform built around clarity and discipline.

By organizing trade data, highlighting performance metrics, and visualizing behavior patterns, it supports traders who want to understand their results more deeply.

Rather than offering shortcuts or promises, the platform focuses on tools that help traders review what they are already doing in the market.

For those willing to engage with their data and commit to consistent review, Trademetria functions as a structured environment for performance analysis and self-improvement.