TradeZella is a cloud-based trading journal and analytics platform built for traders who want a deeper, data-driven view of their performance.

Rather than focusing on trade signals or execution, TradeZella centers on journaling, analytics, backtesting, and trade review.

The platform is commonly used by active traders, prop firm traders, and strategy-focused traders who want to analyze patterns, refine execution, and track long-term progress.

What Is TradeZella?

TradeZella is designed to help traders collect, organize, and analyze their trading data in one place. Users can connect multiple brokerage accounts, import trades automatically or manually, and build a structured trading journal.

From there, the platform provides performance metrics, reporting tools, and backtesting features that allow traders to review past decisions and understand what is driving results over time.

TradeZella does not execute trades or provide market signals. Instead, it functions as an analytical layer that sits on top of a trader’s existing workflow.

Core Platform Features Explained

At its core, TradeZella combines trade journaling with analytics and reporting. Once trades are imported, users can tag entries by setup, mistake, strategy, or market condition.

These tags feed into dashboards that highlight metrics such as win rate, expectancy, drawdowns, and risk exposure.

The analytics interface allows traders to filter performance by date, instrument, position size, or custom criteria.

Visual tools such as charts, equity curves, and performance breakdowns help users interpret results without exporting data to spreadsheets. TradeZella also includes notebook functionality, allowing traders to attach notes, plans, screenshots, and reflections directly to trades or sessions.

TradeZella Pricing and Plans

TradeZella uses a subscription-based pricing model with two paid tiers. Pricing is lower when billed annually.

Essential Plan

- Price: $24 per month when billed yearly ($288 per year)

- Designed for newer or intermediate traders

- Supports one trading account

- Includes core journaling, analytics, reporting, and unlimited backtesting

- Limited playbook creation and no session-level trade replay

This plan covers most journaling and analytics needs but excludes some advanced review tools.

Pro Plan

- Price: $33 per month when billed yearly ($399 per year)

- Designed for advanced and professional traders

- Supports unlimited trading accounts

- Includes session-based trade replay, expanded backtesting tools, and deeper analytics

- Unlimited playbooks and mentor invites

The Pro plan is better suited for traders who rely heavily on replay, multi-account tracking, or detailed strategy analysis.

Trade Replay, Backtesting, and Analysis Depth

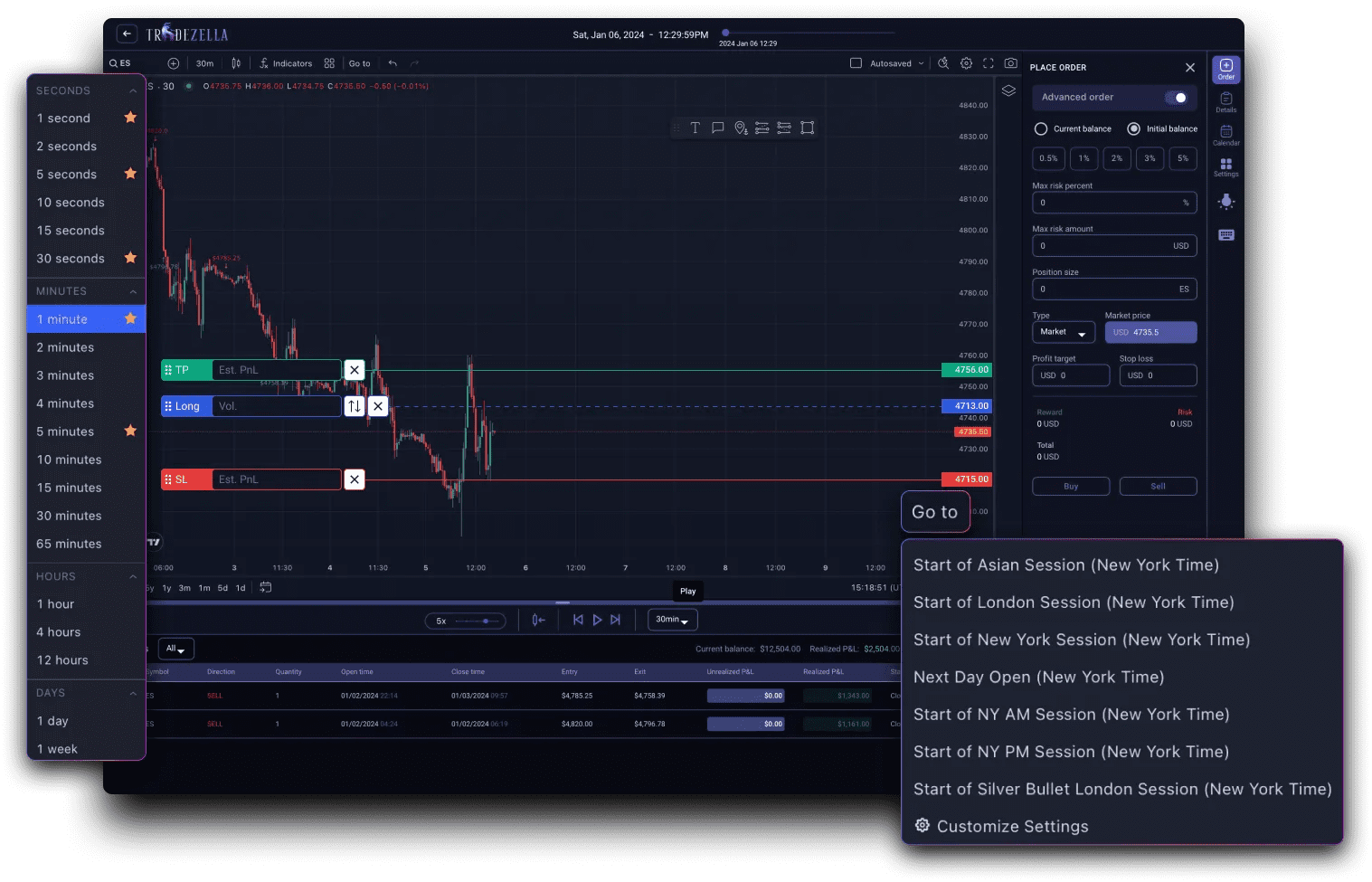

One of TradeZella’s more advanced components is its replay and backtesting functionality. Users can simulate past trading sessions, adjust playback speed, and review executions in sequence. This is particularly useful for identifying timing issues, missed opportunities, or recurring execution errors.

Backtesting tools allow traders to test strategies across historical data using multiple timeframes and indicators. While this does not replace professional-grade backtesting platforms, it provides sufficient depth for evaluating discretionary and rules-based strategies within the journaling environment.

Playbooks, Reporting, and Strategy Tracking

TradeZella includes a structured playbook system that allows traders to define strategies with specific rules and track how those strategies perform over time. Performance metrics can be broken down by playbook, making it easier to identify which approaches are contributing positively and which may need refinement.

Reporting tools cover a wide range of metrics, including risk analysis, wins versus losses, time-based performance, and custom reports based on user-defined tags. These reports are designed to support ongoing review rather than one-time analysis.

Ease of Use and Learning Curve

TradeZella’s interface is modern and visually organized, but it does require an initial learning period. Traders who are new to analytics-heavy platforms may need time to understand how filters, tags, and reports interact. Once set up, daily use is straightforward, especially for traders who already maintain structured journals.

Because the platform is web-based, it can be accessed from any modern browser without additional software installation.

Limitations and Considerations

TradeZella is an analytics and journaling platform, not a trading or execution tool, so it must be used alongside a broker and trading platform.

Its depth of analytics and customization can also require a learning period, particularly for traders who are new to performance tracking or structured journaling.

Additionally, traders who only place occasional trades or prefer very simple tracking may find some of TradeZella’s features more detailed than necessary for their needs.

Who TradeZella Is Best Suited For

TradeZella is best suited for active traders who want a structured, data-driven way to review their performance and identify patterns in their trading behavior.

It is commonly used by prop firm traders and strategy-focused traders who need detailed analytics, trade replay, and performance breakdowns across one or multiple accounts.

The platform is most useful for traders who already follow defined setups and are willing to spend time journaling, reviewing trades, and refining their approach based on objective metrics rather than short-term results.

Frequently Asked Questions

Is TradeZella Free to Use?

TradeZella does not offer a fully free plan. Access to the platform requires a paid subscription, with pricing split between the Essential and Pro plans. Both plans are billed monthly or annually, with lower pricing available on annual billing.

Does TradeZella Place Trades or Connect Directly to Brokers for Execution?

No. TradeZella does not execute trades or act as a brokerage. It functions as a journaling, analytics, and review platform that sits alongside a trader’s existing broker or trading platform.

Can TradeZella Be Used With Prop Firm Accounts?

Yes. TradeZella supports multiple trading accounts and is commonly used by prop firm traders to track performance, analyze rules compliance, and review execution across evaluations or funded accounts.

What Markets Does TradeZella Support?

TradeZella supports a wide range of markets, including stocks, futures, options, and other instruments, depending on the broker data being imported. Market support is tied to the connected brokerage rather than TradeZella itself.

Conclusion

TradeZella is a robust trading journal and analytics platform that prioritizes data, structure, and review.

Its strength lies in helping traders understand why results occur, not in telling them what to trade.

For traders willing to invest time in analysis and journaling, TradeZella offers meaningful depth without replacing existing trading tools.