TrendSpider built its reputation on automation and algorithmic analysis, but many traders eventually reach a point where automation alone no longer feels sufficient.

As trading skills evolve, clarity, control, and depth often matter more than automated pattern recognition. That is why many active traders start exploring TrendSpider alternatives that offer better order flow insight, stronger discretionary tools, or more realistic strategy validation.

This guide breaks down the best alternatives based on real trading needs, not marketing claims. Each platform below solves a specific problem and fits a specific trading style, helping you build a workflow that actually matches how you trade.

Why Traders Look for TrendSpider Alternatives

TrendSpider works well for automated technical analysis, but it does not fit every trader’s approach.

Many traders prefer seeing liquidity, understanding participation, or validating ideas through manual interaction rather than relying on auto-drawn levels and signals.

Others want deeper control over execution, more transparent data, or the ability to replay markets and test decisions step by step. Cost efficiency also plays a role, especially for traders who only need one core function rather than an all-in-one system.

These needs push traders toward platforms that specialize instead of automate everything.

Best TrendSpider Alternatives for Active Traders

1. Bookmap – Best for Order Flow and Liquidity Visualization

Bookmap takes a fundamentally different approach compared to indicator-based platforms. Instead of focusing on historical indicators, it visualizes real-time and historical liquidity directly on the chart using a heatmap.

This allows traders to see where large limit orders sit, how price reacts to them, and when liquidity pulls or absorbs aggressive market orders.

This approach is especially powerful for futures and crypto traders who rely on order flow behavior rather than lagging signals. Absorption, spoofing behavior, and liquidity walls become visible instead of theoretical.

Bookmap does require a learning curve, but once understood, it delivers a level of market transparency that traditional charting tools cannot replicate.

Traders who want to understand why price moves tend to gravitate toward Bookmap.

2. Trade Ideas – Best for AI-Driven Trade Signals

Trade Ideas is built around real-time AI-driven scanning rather than chart analysis alone. Its algorithms continuously analyze thousands of stocks, identifying momentum shifts, volatility expansions, and unusual activity as they happen.

Instead of interpreting charts manually, traders receive actionable ideas supported by statistical modeling. The strength of Trade Ideas lies in speed and breadth.

Intraday equity traders benefit the most, especially those focused on breakouts and momentum continuation. The TradeWave interface simplifies entries and exits visually, reducing chart clutter.

Trade Ideas works best as a decision-support engine rather than a full analysis platform, making it ideal for traders who want ideas generated fast and validated logically.

3. TradingView – Best for Charting and Indicator Ecosystem

TradingView remains one of the most flexible charting platforms available today. Its biggest advantage is the massive indicator ecosystem combined with clean, responsive charts across multiple asset classes.

Traders can customize layouts, build scripts, and test visual ideas without being locked into a single analytical framework.

The platform excels at discretionary analysis, market structure work, and idea sharing. Community-built indicators often rival paid tools, giving traders endless flexibility.

TradingView does not attempt deep automation or order flow analysis, but it offers unmatched versatility for traders who want full control over how charts are built and interpreted.

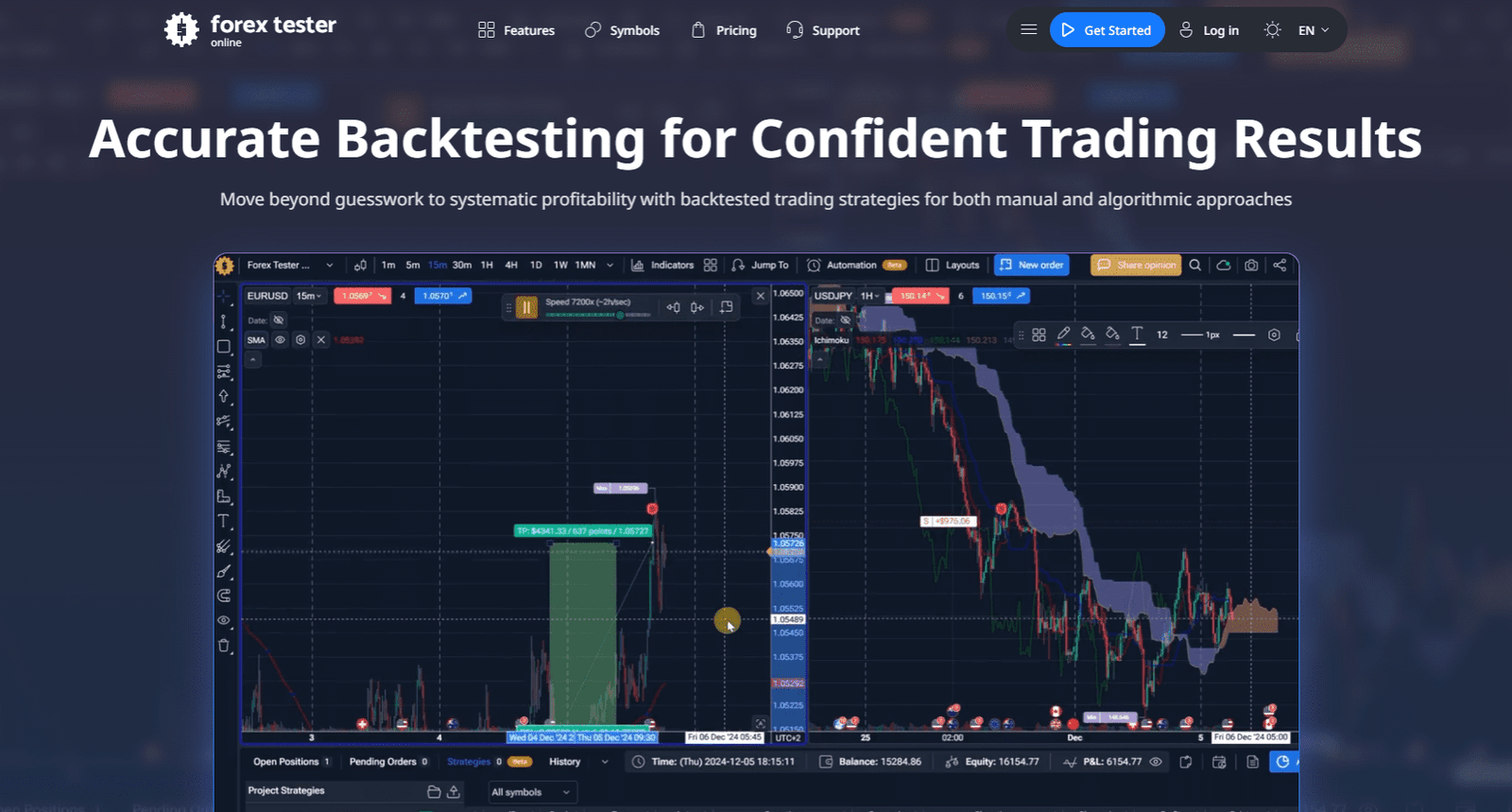

4. Forex Tester Online – Best for Backtesting and Strategy Validation

Forex Tester Online focuses on one critical trading skill: proving a strategy before risking capital. It allows traders to replay historical market data tick by tick, placing trades exactly as they would in live conditions.

This helps traders identify execution mistakes, rule violations, and emotional bias. The platform works especially well for forex and systematic traders who need realistic testing environments.

Unlike simplified backtests, Forex Tester Online emphasizes decision-making quality rather than optimized results.

Traders who value discipline and statistical confidence often use this tool as part of their preparation process.

5. GoCharting – Best for Unified Charting and Order Flow

GoCharting blends advanced charting with order flow and DOM tools in one environment.

It supports futures traders who need fast execution, volume profiling, and depth-of-market analysis without juggling multiple platforms.

The interface balances simplicity with power, making it accessible without sacrificing professional-level features.

Traders who focus on intraday futures and want charting, analysis, and execution tightly integrated often find GoCharting appealing. It bridges the gap between pure charting platforms and specialized order flow tools.

Key Factors to Consider When Choosing a TrendSpider Alternative

Choosing the right platform depends on alignment, not popularity.

Traders should evaluate how much manual controlthey want, how important liquidity visibility is, and how much time they can commit to learning a tool.

Execution speed, market coverage, and pricing structure also matter. Some platforms excel as primary decision engines, while others work best as supporting tools.

Understanding the role a platform plays inside your workflow is more important than feature count.

Which TrendSpider Alternative Fits Your Trading Style

Order flow traders typically lean toward Bookmap or GoCharting due to their liquidity insight.

Momentum-focused equity traders often prefer Trade Ideas for its AI-driven scanning.

Discretionary technical traders benefit most from TradingView’s flexibility and visual clarity.

Strategy builders and disciplined learners gain confidence through Forex Tester Online’s replay environment. Each platform shines when matched to the right trading behavior.

Frequently Asked Questions

Is TrendSpider Still Useful Compared to These Alternatives?

Yes, TrendSpider remains effective for automated technical analysis. Many traders add alternatives to gain visibility, control, or validation that automation alone does not provide.

Which TrendSpider Alternative Works Best for Order Flow Trading?

Bookmap and GoCharting stand out due to their liquidity and DOM visualization. These tools help traders read participation rather than relying on indicators.

Can TradingView Replace TrendSpider Entirely?

TradingView covers charting and indicators extremely well. Traders who rely heavily on automation or AI signals may still need additional tools.

Which Platform Is Best for Testing Strategies Safely?

Forex Tester Online is the strongest option for realistic manual backtesting. It allows traders to build confidence before committing real capital.

Conclusion

There is no universal replacement for TrendSpider because trading itself is not universal. The strongest traders build workflows around clarity, repeatability, and trust in their tools.

Exploring the right TrendSpider alternative often unlocks a deeper understanding of price behavior, execution timing, and decision quality.

Platforms like Bookmap, Trade Ideas, TradingView, Forex Tester Online, and GoCharting each solve a specific problem better than automation alone.

The real edge appears when your tools reinforce how you think, not when they think for you.